Irish Property in Review: Key Takeaways from Q3 and a Look Ahead to Q4 2025

As the autumn colours deepen and we close the books on the third quarter of 2025, it's the perfect time to analyse the key movements in the Irish property market. The last three months have been less about dramatic headlines and more about a quiet but significant shift in priorities for buyers and sellers across the country.

Q3 was a story of stabilisation and strategic decision-making. Here are the key takeaways from the last quarter and what they signal for the final, busy months of the year.

Q3 Takeaway 1: A Market Finding a More Sustainable Rhythm

The frantic, double-digit price growth of recent years has officially calmed. Q3 saw the market settle into a more balanced and sustainable rhythm. While the fundamental mismatch between strong demand and low supply continues to put a floor under prices, the impact of stable interest rates and affordability pressures has tempered the pace of growth.

What this means: This is a sign of a maturing, more predictable market. For buyers, it means less chance of being drawn into frenzied bidding wars. For sellers, it means that pricing correctly from the outset is more important than ever.

Q3 Takeaway 2: The "BER Premium" is Now the Standard

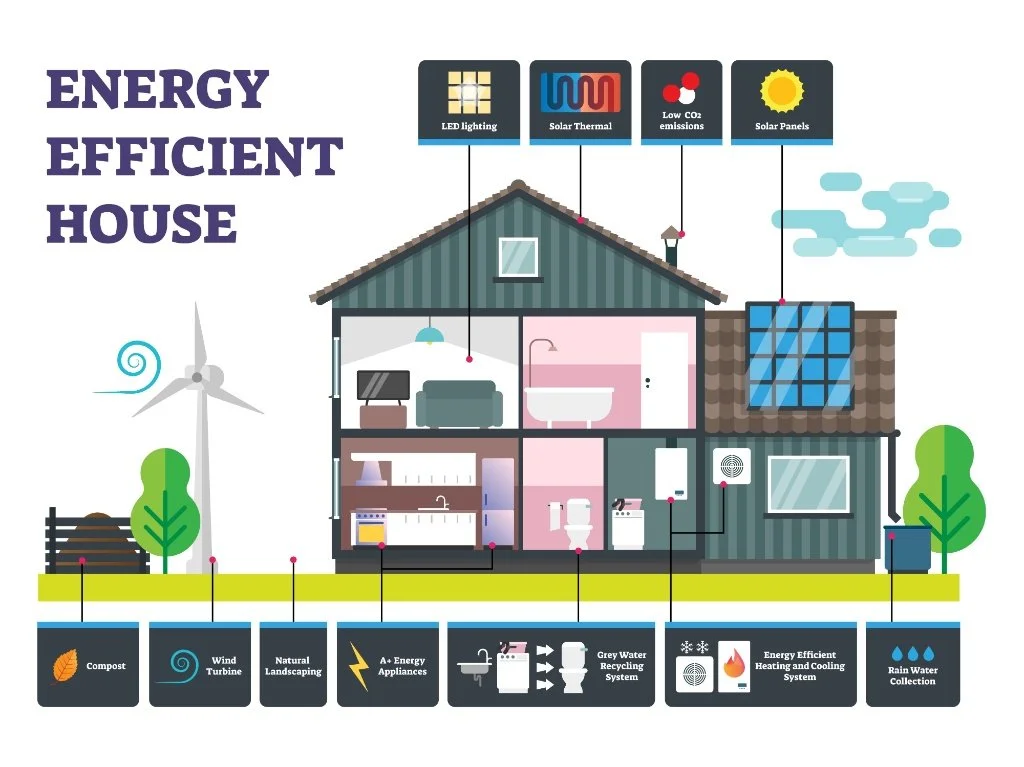

If there was one standout trend in Q3, it was the undeniable dominance of energy efficiency. The gap in value and desirability between homes with a high Building Energy Rating (BER) of A or B and less efficient, older properties (F or G) has become a chasm.

What this means: Buyers are no longer just looking at the purchase price; they are calculating the long-term running costs of a home. A high BER rating is no longer a "nice-to-have"—it's a critical asset that leads to faster sales and premium prices. This is the new standard in Irish property.

Q3 Takeaway 3: The Commuter Belt's Appeal Endures

The hybrid working model is now a permanent fixture of Irish professional life, and the property market in Q3 reflected this. Counties surrounding Dublin, such as Meath, Kildare, and Wicklow, continued to experience robust demand.

What this means: The search for more space, a garden, and a dedicated home office remains a primary driver for many buyers. Towns with excellent transport links, top-tier schools, and a strong sense of community are thriving. This trend shows no signs of slowing down.

A Look Ahead: What to Watch for in Q4 2025

As we enter the final quarter, several key factors will shape the market.

The Budget 2026 Effect: The upcoming budget announcement in October is the single biggest factor on the horizon. Decisions on the Help to Buy scheme, landlord taxation, and grants for retrofitting will set the tone for the market heading into 2026.

The Traditional Autumn Rush: Q4 is typically one of the busiest periods for property transactions. We expect a final flurry of activity from motivated buyers and sellers looking to agree deals before the Christmas slowdown.

A Continued "Flight to Quality": The trends from Q3 will only intensify. Well-presented, energy-efficient homes in sought-after locations will continue to be in high demand and achieve strong results. The market is becoming more discerning.

Our Final Thoughts

The Irish property market is moving into a new phase—one that is more stable, rational, and intensely focused on quality and long-term value. Understanding these nuances is the key to making a successful move.

Whether you're planning to buy or invest this autumn, navigating the current market requires expert insight. The GoldGro team is here to provide you with the data-driven advice you need to achieve your property goals. Contact us today for a confidential consultation.