Ireland vs. US: The Exclusive Advantage

A Data-Driven Guide for High-Net-Worth Individuals

Presented by

GOLDGRO

Your Pathway to Irish Residency, Education & Wealth Management

Executive Summary

This comprehensive report provides high-net-worth individuals with data-driven insights comparing the United States and Ireland across key metrics that impact lifestyle, security, and wealth preservation. In an increasingly complex global landscape, the decision to relocate requires careful consideration of numerous factors.

Our analysis reveals that Ireland offers distinct advantages across multiple dimensions important to discerning individuals and families. From its newly achieved #1 global passport ranking to its favorable tax treatment for non-domiciled residents, Ireland presents a compelling alternative to the United States.

Ireland's Passport Now Ranks #1 Globally

According to the 2025 Nomad Passport Index by Nomad Capitalist, Ireland now officially has the strongest passport in the world, providing unparalleled global mobility for citizens and a pathway to European Union benefits.

Global Passport Ranking

This report examines the key areas essential to making an informed decision about relocation, including quality of life metrics, healthcare systems, luxury property markets, safety considerations, and tax implications. Each section provides objective data comparisons to help you evaluate whether Ireland aligns with your personal and financial objectives.

Ireland's #1 Ranked Passport

In a significant development for 2025, Ireland's passport has achieved the top position in global rankings according to the respected Nomad Passport Index. This prestigious recognition comes after years of Ireland consistently placing in the top tier of global passport rankings.

Key Benefits of Irish Citizenship

Visa-Free Access

Irish passport holders enjoy visa-free or visa-on-arrival access to 189 countries and territories, facilitating seamless global travel for business and leisure.

EU Membership Benefits

Full rights to live, work, and do business throughout the European Union, with access to the world's largest trading bloc.

Dual Citizenship

Ireland permits dual citizenship, allowing individuals to maintain their original nationality while gaining the advantages of Irish citizenship.

For high-net-worth individuals seeking enhanced global mobility and access to European markets, the pathway to Irish citizenship represents a strategic opportunity. The Irish passport's new #1 ranking further cements its value in an increasingly restrictive global environment.

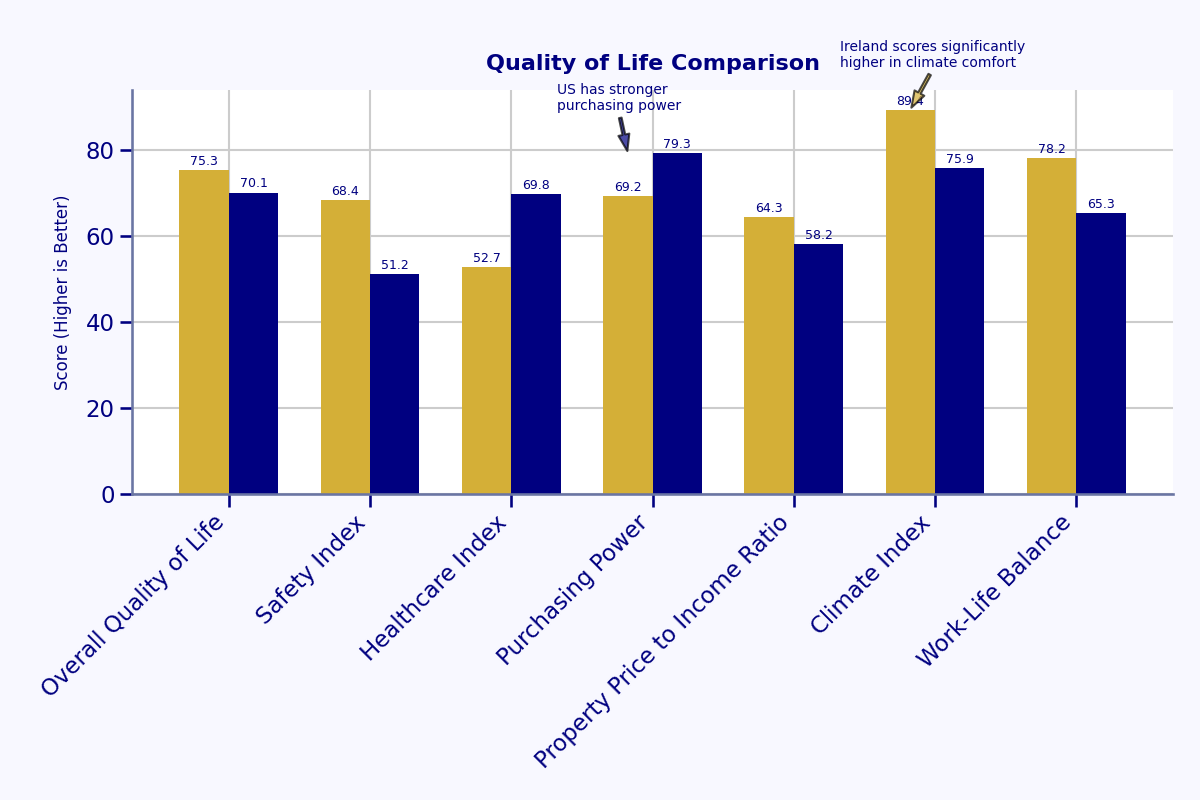

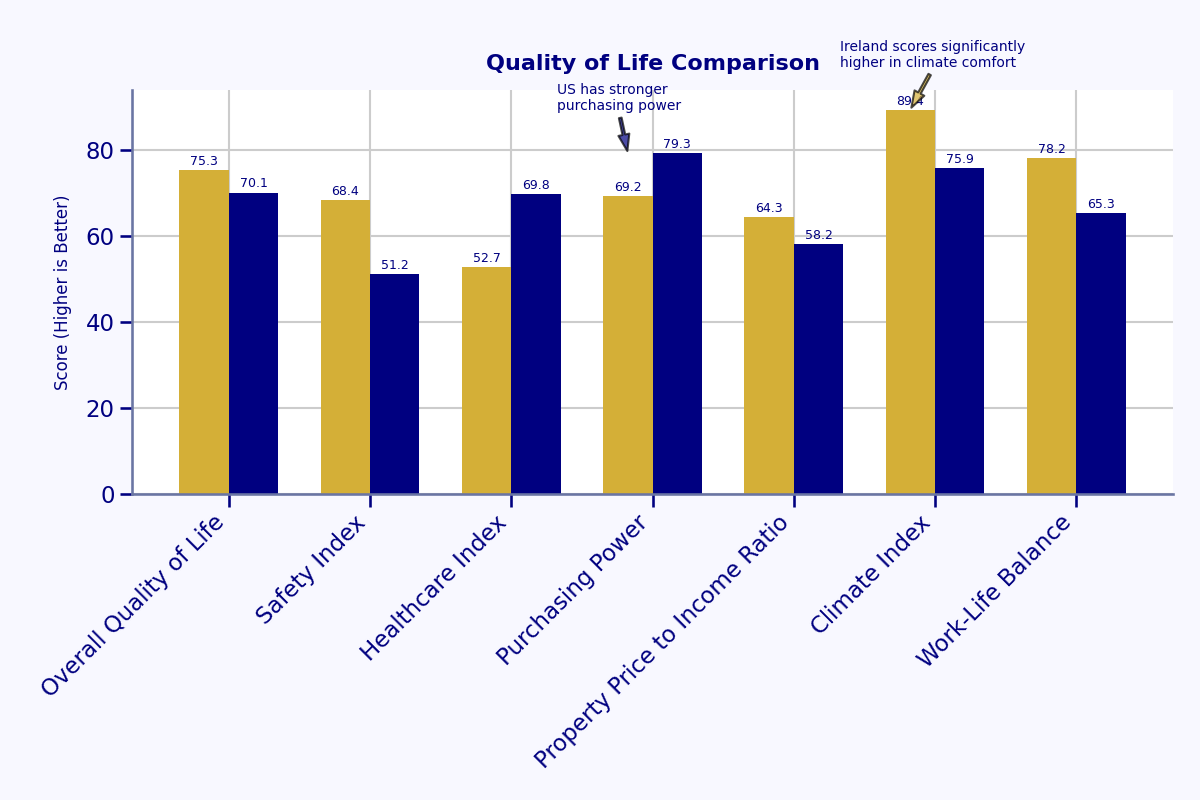

Quality of Life Comparison

When evaluating potential relocation destinations, quality of life metrics provide essential insights into the daily experience and overall well-being you can expect. Our data analysis reveals that Ireland outperforms the United States across several key quality of life indicators.

Work-Life Balance

Ireland's approach to work-life balance differs significantly from the United States. With stronger employee protections, more generous vacation policies, and a cultural emphasis on leisure time, Ireland offers high-net-worth individuals and their families more opportunity to enjoy their success.

Environmental Quality

Ireland's lower population density, strong environmental protections, and abundant natural landscapes contribute to superior air quality and access to nature compared to many urban centers in the United States. This environmental advantage translates to tangible health benefits and lifestyle opportunities.

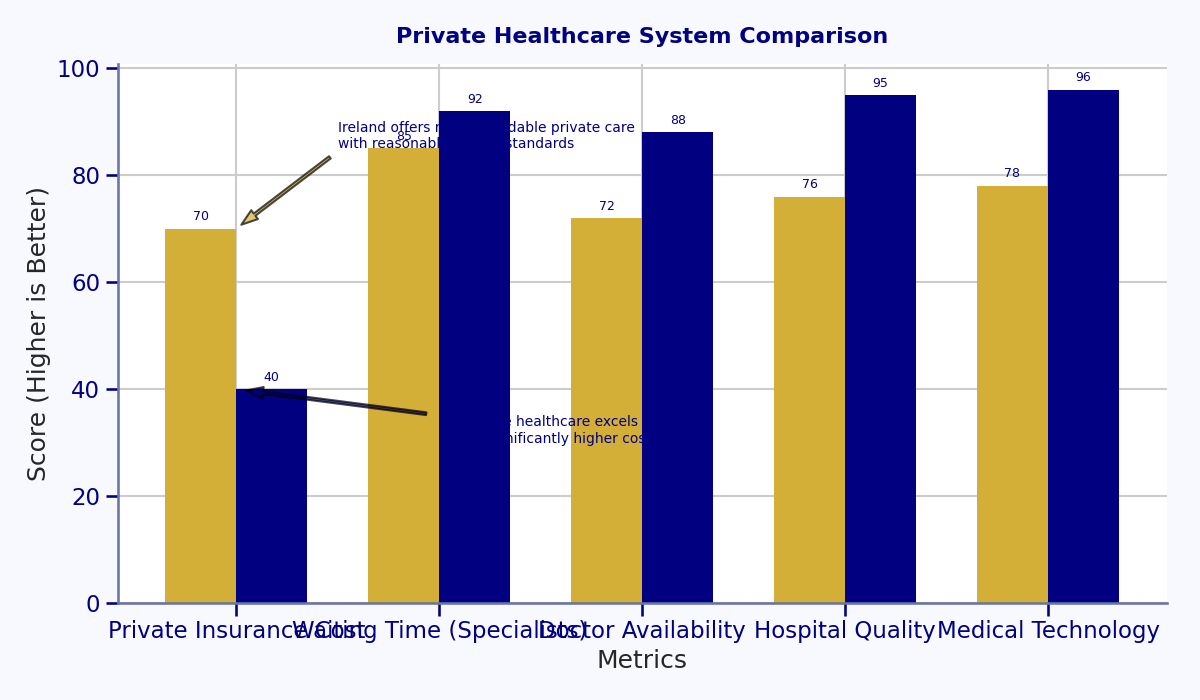

Private Healthcare System Comparison

Healthcare quality and accessibility are paramount considerations when relocating. Ireland offers a dual-system approach with both public and private healthcare options, providing flexibility and choice for high-net-worth individuals.

Ireland's Healthcare System Overview

Ireland's healthcare system comprises both public and private sectors, delivering a comprehensive range of services to its residents. The public healthcare system is primarily funded through taxation, while the private sector offers additional options for those seeking more immediate access to services.

For high-net-worth individuals, the private healthcare system in Ireland offers:

- Shorter waiting times for specialist consultations and procedures

- Access to private hospitals and clinics with premium amenities

- Direct appointments with specialists without GP referrals

- More personalized care and comfort during treatment

- Comprehensive health insurance options with global coverage

Private Healthcare Benefits

Cost Efficiency

Private healthcare in Ireland is considerably more affordable than equivalent services in the United States, with premium insurance plans costing approximately 60-70% less annually while providing comprehensive coverage.

Specialist Access

Private healthcare in Ireland offers direct and timely access to specialists without the lengthy referral processes common in the US system, resulting in more efficient diagnosis and treatment timelines.

International Integration

Many Irish private health insurance plans offer seamless international coverage, facilitating continuity of care during global travel and providing access to prestigious medical facilities worldwide.

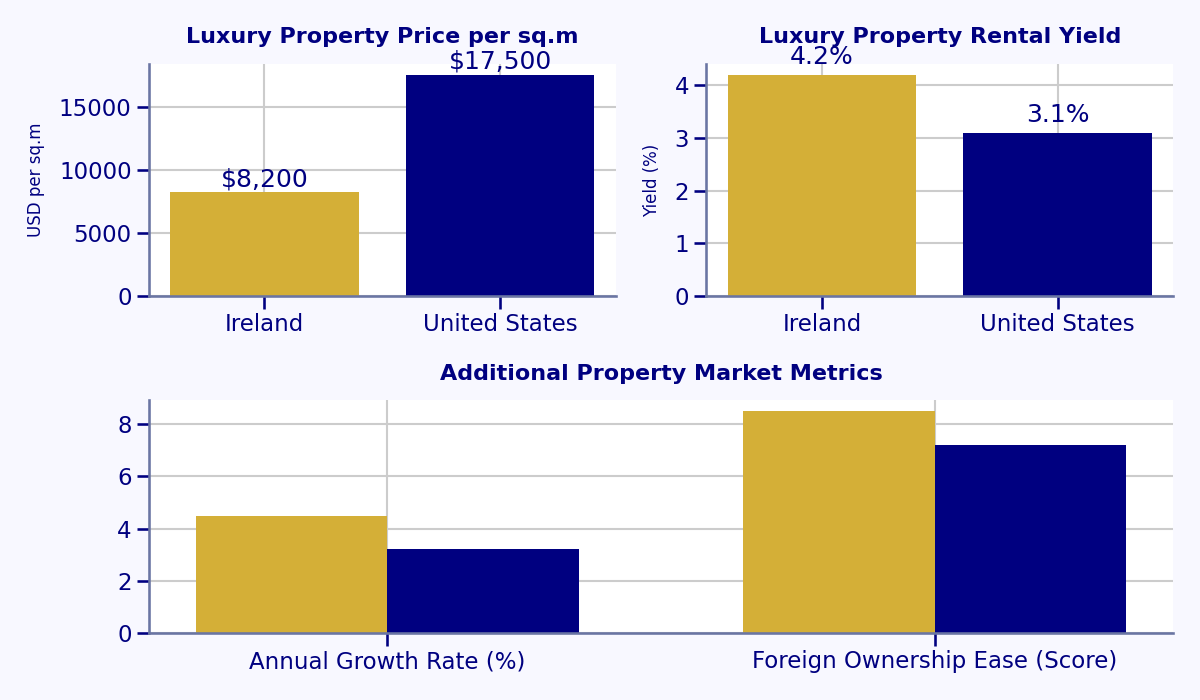

Luxury Property Market Comparison

The luxury real estate market represents both a significant lifestyle consideration and an investment opportunity. Our analysis of high-end property markets in Ireland versus the United States reveals notable distinctions in value, appreciation potential, and acquisition costs.

Value Proposition

Luxury properties in Ireland typically offer greater value per square meter compared to equivalent properties in premier US markets like New York, San Francisco, or Miami, providing more expansive living spaces and grounds for the investment.

Historic Properties

Ireland offers unique opportunities to acquire historic estates, castles, and manor houses with provenance dating back centuries—assets with intrinsic cultural and historical value rarely available in the US market.

Acquisition Costs

Total acquisition costs, including transfer taxes and legal fees, are generally lower in Ireland (typically 2-3% of property value) compared to high-tax US states where combined costs can exceed 5-8% of property value.

Key Luxury Markets in Ireland

| Location | Market Characteristics | Investment Outlook |

|---|---|---|

| Dublin (D4, D6) | Premier urban residences with historic architecture and close proximity to business districts, cultural venues, and international schools | Strong appreciation potential driven by limited supply and consistent international demand |

| County Wicklow | Exclusive country estates offering privacy and natural beauty within commuting distance to Dublin | Stable long-term value with growing appeal to international buyers seeking privacy |

| Cork & Kinsale | Coastal luxury properties with spectacular ocean views and access to yachting facilities | Emerging luxury market with strong growth potential as international awareness increases |

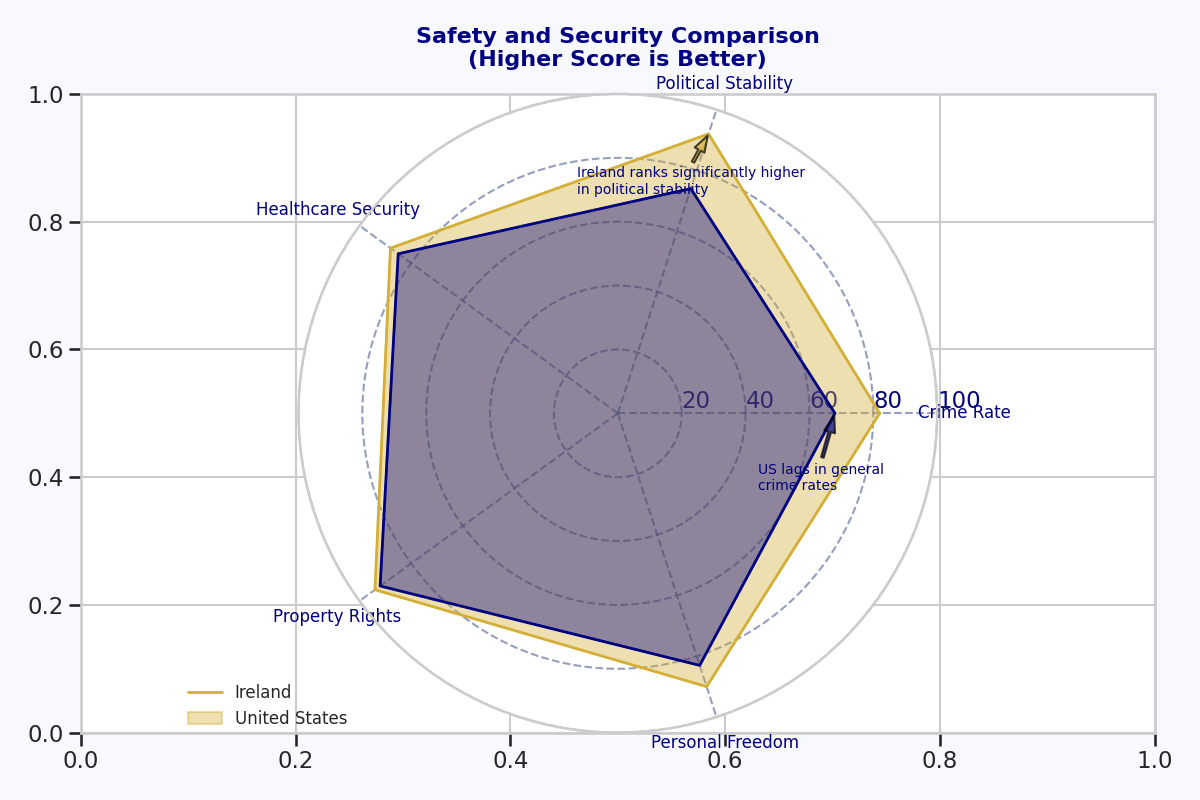

Safety and Security Comparison

Personal safety and security are fundamental considerations for high-net-worth individuals and their families. Our data analysis reveals significant advantages in safety metrics when comparing Ireland to the United States.

Personal Safety Advantages

Ireland consistently ranks as one of the safest countries globally, with significantly lower rates of violent crime compared to the United States. This translates to tangible lifestyle benefits for high-net-worth individuals and their families.

Security for High-Net-Worth Individuals

The security environment in Ireland offers specific advantages for high-net-worth individuals concerned about privacy, asset protection, and family safety.

- Lower Profile: Wealth is generally less conspicuous in Irish society, reducing security concerns related to visible affluence

- Privacy Protection: Stronger legal frameworks protecting personal privacy and limiting public access to personal information

- Gated Communities: Availability of secure, discreet luxury estates and developments with sophisticated security systems

- Political Stability: Ireland's stable political environment minimizes risks associated with civil unrest or political volatility

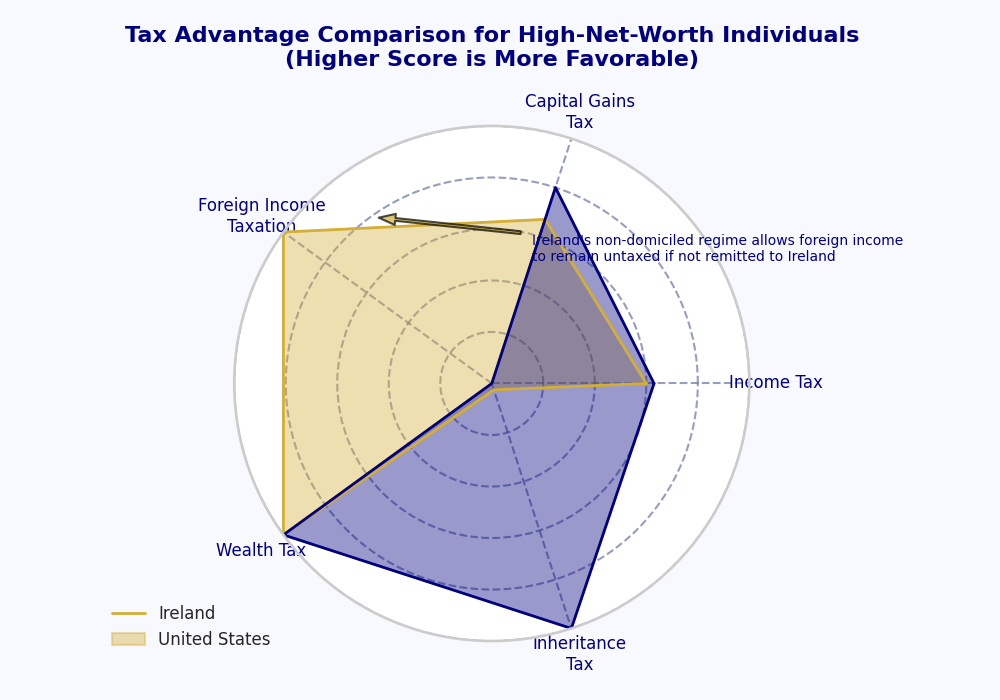

Tax Advantages in Ireland

One of the most compelling reasons high-net-worth individuals consider Ireland is its favorable tax environment, particularly for those with international income sources and investments. Ireland's tax system offers significant advantages through its non-domiciled resident status.

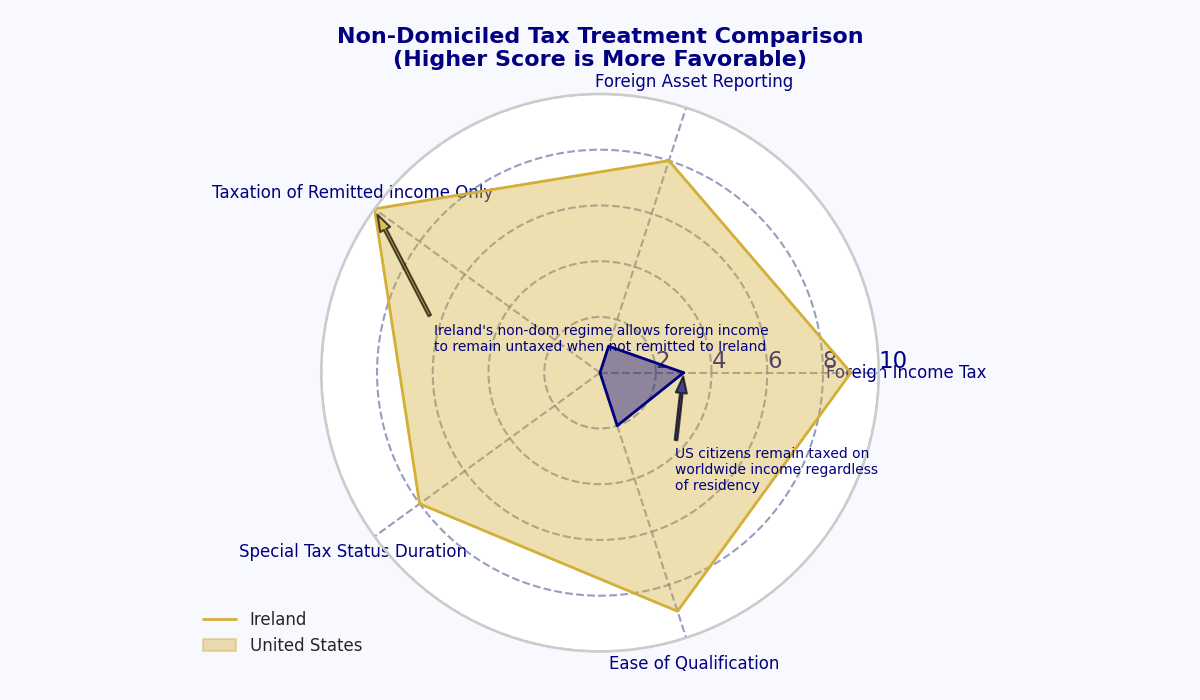

Non-Domiciled Tax Treatment

Remittance Basis Taxation

Ireland's tax system allows non-domiciled residents to be taxed on the "remittance basis," meaning:

- Irish-source income is taxed in Ireland

- Foreign income is only taxed if remitted (brought into) Ireland

- Foreign income kept outside Ireland can potentially remain untaxed by Irish authorities

- No time limit on non-domiciled status, unlike other jurisdictions

Strategic Advantages

Wealth Accumulation

Foreign income and capital gains not brought into Ireland can potentially accumulate tax-free from an Irish perspective, facilitating more efficient global wealth management.

Estate Planning

Non-Irish assets owned by non-domiciled residents may be structured to fall outside the scope of Irish inheritance tax, enabling more efficient intergenerational wealth transfer.

Investment Flexibility

The remittance basis allows for strategic allocation of investment activities between Irish and non-Irish sources based on tax considerations.

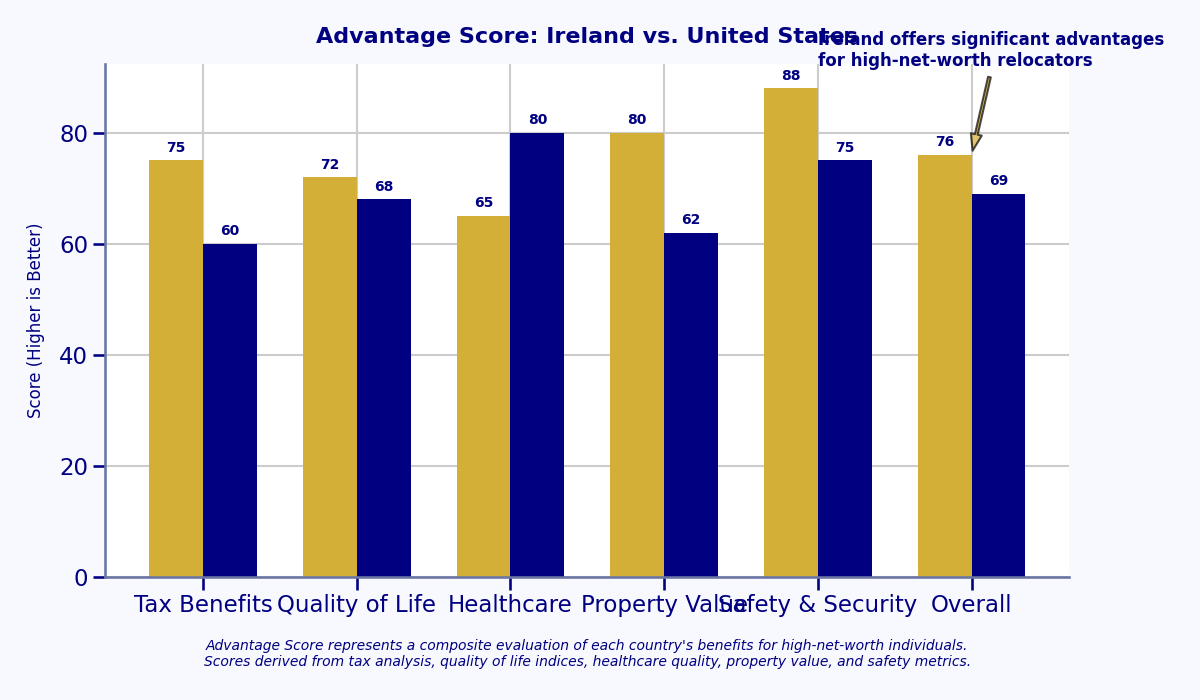

Conclusion: The Ireland Advantage

Our comprehensive data analysis demonstrates that Ireland offers high-net-worth individuals a compelling alternative to the United States across multiple dimensions:

Strategic Benefits

- #1 Ranked Global Passport offering unparalleled mobility and access

- Favorable Tax Environment through non-domiciled status

- Superior Quality of Life with better work-life balance

- Enhanced Personal Security with significantly lower crime rates

- Access to EU Markets and free movement within Europe

- Luxury Property Value with unique acquisition opportunities

Next Steps

While the data presents a clear case for the advantages of Ireland, the decision to relocate requires personalized assessment and planning. Each high-net-worth individual and family has unique circumstances, priorities, and objectives that must be carefully considered.

GoldGro specializes in providing bespoke relocation solutions for discerning clients considering Ireland as their next destination. Our comprehensive services include:

- Personalized residency pathway planning

- Tax optimization strategy development

- Luxury property acquisition assistance

- Private education placement for children

- Wealth management and preservation structures

- Comprehensive relocation concierge services

Begin Your Journey to Ireland

Contact Information

To discuss how GoldGro can assist with your relocation to Ireland, please contact our team:

Ireland (Toll-free):

1800100012 (For calls within Ireland only)

Website:

Our Services

- Stamp 0 Visa Advisory

- Wealth Tax & Property Solutions

- Concierge Relocation

- Education Planning

- Full-Service Immigration Support

- Tax Optimization Strategy

Schedule a confidential consultation to discuss your personal circumstances and objectives.

Request ConsultationDisclaimer

This report is provided for informational purposes only and does not constitute legal, tax, or financial advice. The information contained herein is based on data available as of April 2025 and may be subject to change. Individual circumstances vary, and professional advice should be sought before making any decisions regarding international relocation or tax planning. GoldGro Limited does not guarantee any specific outcomes and bears no responsibility for actions taken based on the information contained in this report.